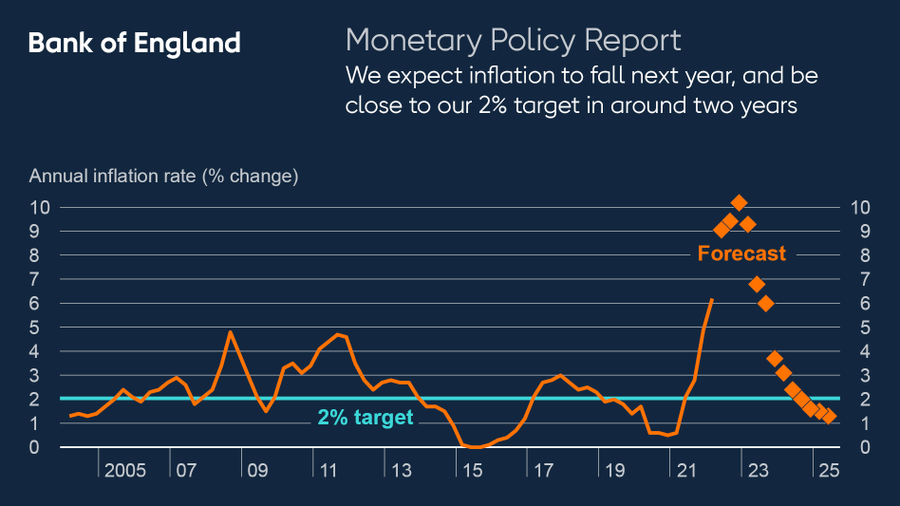

Bank of England base rate

The increase means it is the third time in quick succession. The base rate was increased from 025 to 050 on 3 February 2022 to try and control inflation.

Two Years And Counting Bank Of England Still Trying To Decode Labor Market Labour Market Bank Of England Decoding

The current Bank of England base rate is 075.

. The increase means it is the fourth time in quick succession. It was raised to 025 in December 2021 and again to 05 in February 2022. 2 days agoThe Bank of England BoE base rate is often called the interest rate or Bank Rate and sets the level of interest all other banks charge.

If it does this will set rates at the highest level seen since the global. The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn. May 5 2022.

If the Bank of England does raise the base rate to one percent this will be the fourth consecutive hike since the financial institution started raising borrowing costs in. This sets the Bank of England base. The aim of the base rate reduction was to help control the economic impact of coronavirus on the UK economy.

1 day agoLONDON The Bank of England is expected to opt for a fourth consecutive interest rate hike on Thursday but economists fear it is entering. The new Bank of England base rate at 1 is a level not seen since 2009 Joe GiddensPA PA Archive. Inflation has reached a 13-year high of 10 prompting the Bank of England BOE to increase interest rates by 05 meaning that the base interest rate is now 1.

Despite mounting concern the UK economy is weakening due to the cost of living crisis today the Bank of England is expected to raise interest rates. In the news its sometimes called the Bank of England base rate or even just the interest rate. The rate rise to.

The change means higher mortgage payments for more than two million. Interest is a fee you pay for borrowing money and is what banks pay you for. 11 hours agoBank of England hikes interest rates to 1 as millions of businesses and households battle against rampaging inflation.

The Bank of England base rate is currently 075. The Bank of England BoE is the UKs central bank. A day after the US.

It is the fourth consecutive hike since December as households have had to grapple with record consumer prices. 16 hours agoThe Bank of England has raised the base rate of interest to 1 - the fourth consecutive increase as it continues to move against surging inflation - despite issuing a warning about a recession ahead. The base rate is used by the central bank to charge other banks and lenders when they borrow money and influences what borrowers pay and savers earn.

Bank of England raises interest rates to 1 -. Bank of England set to raise base rates despite risk of recession. Our Monetary Policy Committee MPC sets Bank Rate.

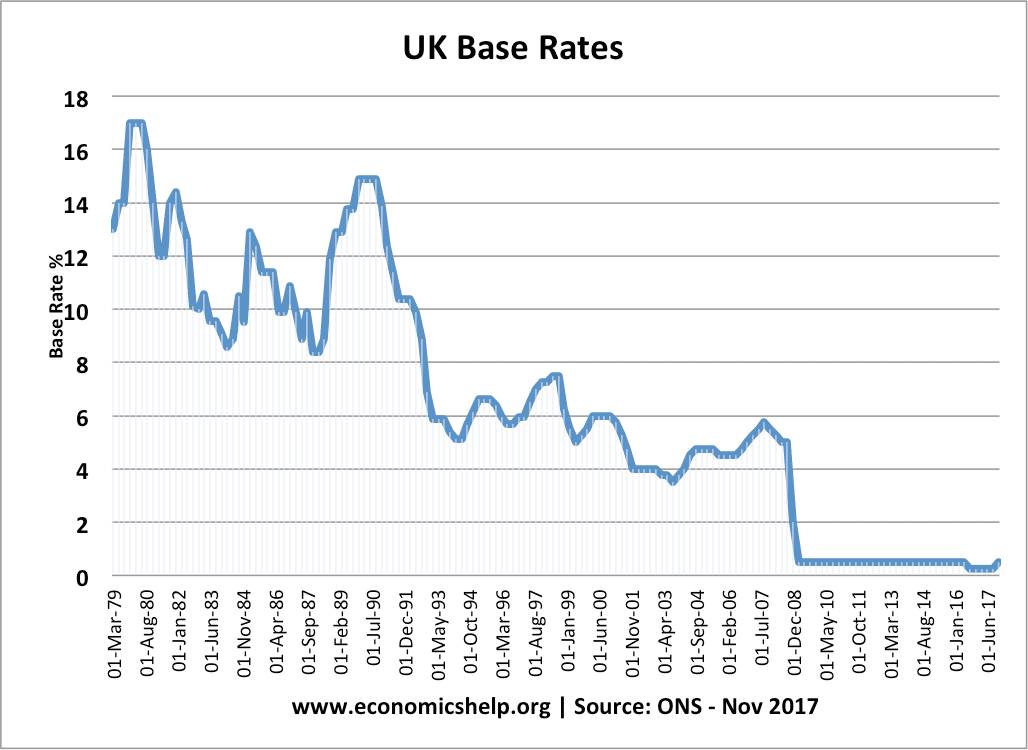

47 rows In 2007 the Bank of England interest rate was around 55. 70 Current inflation rate Target 20. The bank reduced the base rate from 075 to 025 1 week earlier on 11 March 2020.

14 hours agoMay 5 2022. The Bank of England hiked the base rate to its highest level for 13 years today with a 025 per cent rise to 1 per cent. The Bank of England hiked the base rate to its highest level for 13 years today with a 025 per cent rise to 1 per cent.

11 hours agoSince December 2021 the UKs central bank has increased the base rate four times meaning the base rate has gone up from 01 per cent to 1 per cent. The base rate was previously reduced to 01 on 19 March 2020 to help control the economic shock of coronavirus. 11 hours agoThe base rate is the interest rate that the Bank of England charges commercial banks for loans and until now stood at 075.

Zoe Tidman 5 May 2022 0859. The Bank of England has increased base rates to 075 from 05 after the Monetary Policy Committee MPC voted in favour of a rise. 12 hours agoThe Bank of England has increased base rates to 1 from 075 after the Monetary Policy Committee MPC voted in favour of a rise.

By Denis Sheehan Publisher HC News. Federal Reserve raised its benchmark rate by half a percentage point - its biggest hike since 2000 - to a range of 075 to. The base rate dropped to an all time low of 01 following the outbreak of the coronavirus pandemic in March 2020.

2 days agoThe Bank of England this week is expected to raise interest rates to their highest level in 13 years and clarify how it plans sell off some of. Its part of the Monetary Policy action we take to meet the target that the Government sets us to keep inflation low and. Bank of England expected to raise base rate to highest level in 13 years as walks very fine line between cooling inflation and avoiding recession.

The rate rise to battle surging inflation now expected to average 10 per cent over autumn should benefit savers but will hit mortgage borrowers and businesses who face higher borrowing costs. Our mission is to deliver monetary and financial stability for the people of the United Kingdom. 8 hours agoCristian Bustos.

Bank Rate is the single most important interest rate in the UK. Bank of England top brass have hiked interest rates from 075 to 1. May 5 2022 1026 am.

The Bank of England BoE base rate which will be reviewed on Thursday May 5 impacts high street bank interest rates.

Countries Come Together In Hope Of Creating Cryptocurrency Backed By Central Banks Bank Of England Bank For International Settlements Cryptocurrency

Pin On Numerology January 2020

Uk Interest Rates Rise For First Time In 10 Years Interest Rate Chart Interest Rates Rate

United Kingdom Interest Rate Uk Economy Forecast Outlook

The 5 000 Year History Of Interest Rates Shows Just How Historically Low Us Rates Are Right Now Gold Rate Interest Rates Low Interest Rate

Traders Bet U K Will Have Negative Interest Rates By Year End Bank Of England Interest Rate Swap Uk Banks

Traders Low Expectations For Boe Rate Stir Complacency Debate Debate Expectations How To Plan

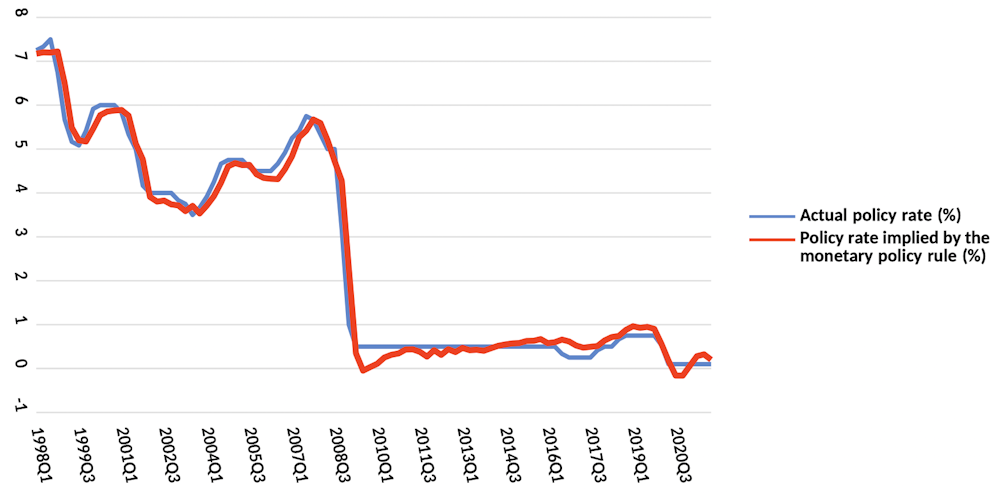

How The Bank Of England Set Interest Rates Economics Help

I Ve Fine Tuned A Tool That Advises The Bank Of England What Interest Rates To Set Here S What It Says

Historical Interest Rates Uk Economics Help Interest Rates Economics Rate

Uk Housing Market Economics Help Mortgage Rates Bank Rate Mortgage Lenders

Quantitative Easing Not As We Know It Government Corporation Advanced Economy Low Interest Rate