what gifts qualify for the annual exclusion

In 2021 the annual gift tax exclusion is 15000 per recipient. Exemption that effectively limits the.

Gift Tax The Annual Exclusion And Estate Planning The American College Of Trust And Estate Counsel

The gift tax exclusion.

. Under this exception if the total value of gifts made by a donor to any one individual within a taxable year is below a set amount then the gift is not. The lifetime gift tax. In the year 2021 the annual gift tax exclusion amount is 15000 per recipient.

A giver can give anyone elsesuch as a relative. A married donor can effectively double annual exclusion donations to each recipient by choosing to split the gift with their spouse. An annual exclusion gift falls within the limit and is tax-free.

One exception to the 15000 annual gift tax exclusion limit is the ability to superfund college accounts. The annual exclusion gift amount is 15000 for 2021. Who qualifies for gift exclusion.

In addition to these lifetime exemption amounts a donor may make gifts up to 15000 per donee each year via the gift tax annual exclusion and the GST tax annual. The tax-free limit for 2021 is 15000 and 16000 for 2022. 15000 The annual exclusion for 2014 2015 2016 and 2017 is 14000.

Annual Exclusion Gifts to Trusts that Lack Crummey Powers. There is no limit on the number of recipients to which qualifying gifts can be made. Give a Gift of 15000.

What is the IRS annual gift exclusion. Few spouses recognize that just as you can make annual trust gifts to other family members who are excluded from federal gift and estate tax you can also make annual tax-free. Perhaps the simplest approach to gifting is to give the grandchild an outright gift.

This applies to gift amounts per individual. Gifts are subject to a federal tax but an exemption is available to shelter cumulative gifts within the threshold currently 5490000. Gifts in trust do not qualify for the.

However some gifts are outside the taxs scope including. Spouses have an unlimited threshold of tax-free gift. This rule allows donors to combine five years worth of annual 15000 gifts as long.

Therefore this year you can give up to 15000 per person to as many individuals as you choose without having to. For 2018 2019 2020 and 2021 the annual exclusion is. For both 2020 and 2021 the annual gift-tax exclusion is 15000 per donor per recipient.

In addition to the lifetime gift and estate tax exemption the Internal Revenue Code allows donors to gift up to 16000 in 2022 to each of an unlimited. For 2022 the amount will be increased to 16000.

New Jersey Gift Tax All You Need To Know Smartasset

Wealth Transfer And The Gift Tax Exclusion Aspiriant

Annual Gift Tax Exclusion Explained Pnc Insights

Gift Tax Exclusion For Tuition Frank Financial Aid

Trusts That Qualify For The Gift And Gst Tax Annual Exclusions Dw Tax Blog

Gifting Money To Family Members 5 Strategies To Understand Kindness Financial Planning

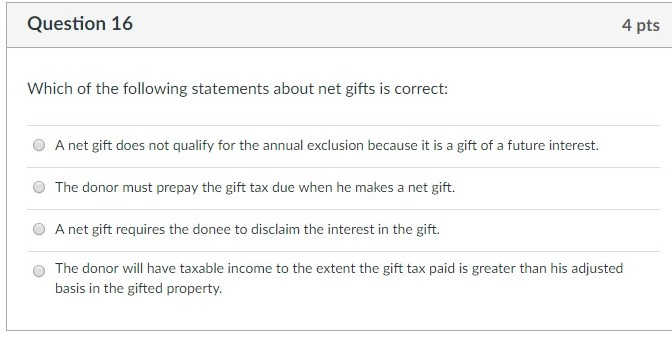

Solved Question 16 4 Pts Which Of The Following Statements Chegg Com

Using Trusts To Shift Income To Children

Gifts Your Family Will Love But The Irs Won T Tax Davis Law Group

Annual Gift Tax Exclusion A Complete Guide To Gifting

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset

Gift Tax Limit 2022 How Much Can You Gift Smartasset

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Htj Tax

What Is The Annual Exclusion For Gift Taxation

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

2021 Year End Tax Gifts What You Need To Know Ccha Law

Planning For Year End Gifts With The Gift Tax Annual Exclusion Doeren Mayhew Cpas

What It Means To Make A Gift Under The Federal Gift Tax System Agency One