us japan tax treaty article 17

According to an Ipsos poll taken in March 76 percent of Australians support the country signing and ratifying the treaty while only 6 percent are opposed. The Federal estate and gift taxes.

Simple Tax Guide For Americans In Japan

Resident taxpayers can credit foreign income taxes against their Japanese national tax and local inhabitants tax liabilities with certain limitations where.

. Us japan tax treaty article 17. In the case of Japan. 1 a business entity formed in the United States or 2 any other person except a corporation or any entity treated under United States law as a.

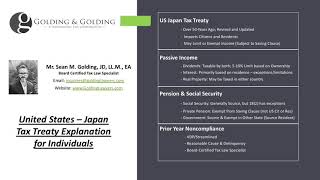

Japan is also one of the United States longest. Tax Conventions principally for the elimination of double taxation and the prevention of tax evasion and avoidance 2. Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18.

Foreign tax relief. Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments. Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013.

Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on. A in the case of Japan. In the case of the United States of America.

Security taxes to both the united states and japan for the same work. Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on. Us japan tax treaty article 17.

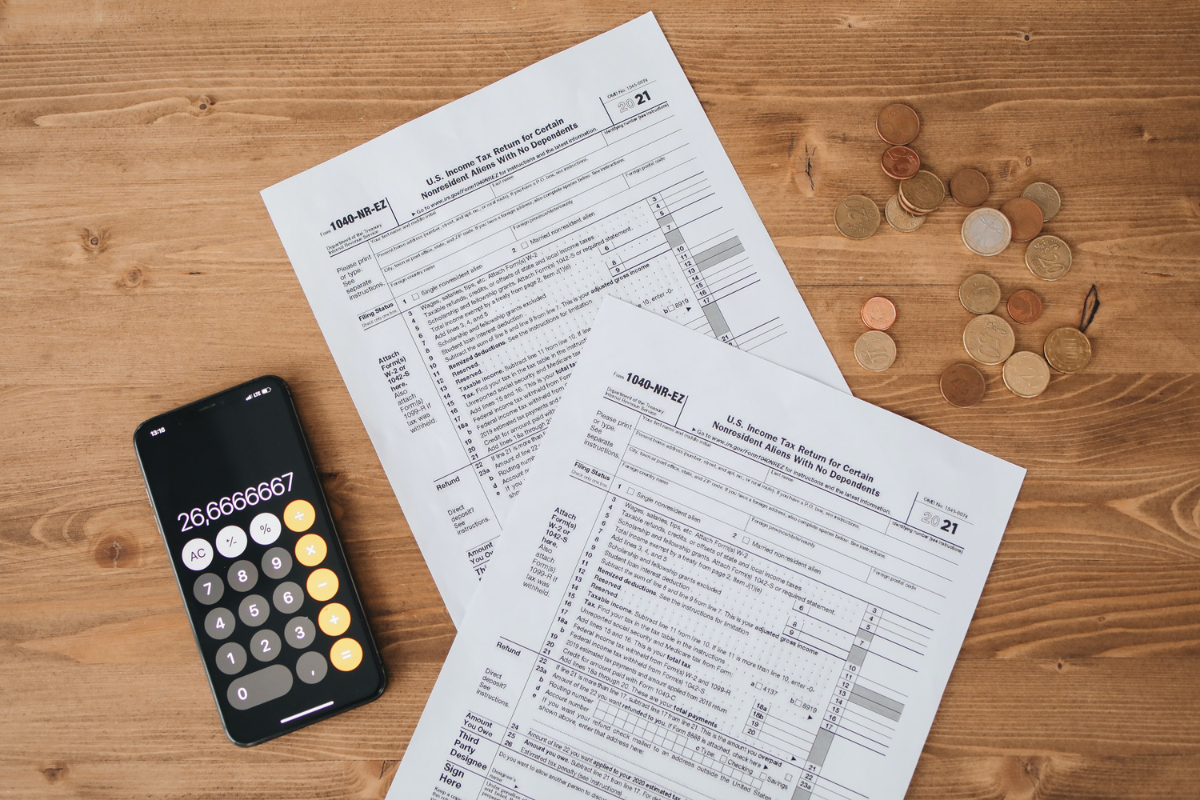

Saturday July 2 2022. APPLICATION FORM FOR INCOME TAX CONVENTION Form 7 PDF267KB Relief from Japanese Income Tax and Special Income Tax for Reconstruction on Income Earned by. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens and.

Amended Japan-US Tax Treaty. As of August 8 2022. Japan Tax Treaty.

Article 17 Pension in the US Tax Treaty with Japan. Updated treaties were signed in. The taxes referred to in the present convention are.

Entry into effect a the provisions of the mli shall have effect in each contracting. The United States and Japan entered into a bilateral international income tax treaty several years ago. Japan is also one of the United States longest-standing tax treaty partners.

The term resident of the United States means. The first US-Japan income tax treaty was concluded in 1954. The proposed treaty would replace this treaty.

The Government of Japan and the Government of the United States of.

Us Taxation Of Uk Pension Plans Htj Tax

Usa India F 1 J 1 Tax Treaty Students Business Apprentice O G Tax And Accounting

Canada Tax 101 What Is A W 8ben Form Freshbooks Blog

Singapore Japan Double Taxation Agreement

Japan The Ministry Of Justice S Recent Notice To Tech Giants May Affect Tax And Business Planning In Japan For All Overseas Businesses Global Compliance News

The Ultimate Tax Guide For American Nomads Expats 2021 Nomad Gate

Japan Tax Income Taxes In Japan Tax Foundation

Us Taxation Of Uk Pension Plans Htj Tax

What Is The Uk Portugal Double Taxation Treaty Rhj Accountants

How To Calculate Your Foreign Tax Credits Carryover With Examples

U S Estate Tax For Canadians Manulife Investment Management

Korea Taxation Of Cross Border M A Kpmg Global

Us Tax Tips For American Expats Who Retire In Japan Bright Tax

Tax Treaties European Tax Treaty Network Tax Foundation

When Does The Ch Us Tax Treaty Apply To Us Citizens Kpmg Schweiz

Let S Talk About Us Tax Implications Of The Malta Treaty Htj Tax

Japan Tax Income Taxes In Japan Tax Foundation

Japan Tax Income Taxes In Japan Tax Foundation

Japan United States International Income Tax Treaty Explained